Scandinavian companies continue to operate in Russia

Scandinavian companies continue to operate in Russia

The majority of Scandinavian companies continue to operate in Russia even after Kremlin forces invaded Ukraine, according to «Chronicles.Media.» Some organizations have remained silent, while others have only formally departed, retaining ownership rights to Russian legal entities. This is despite the fact that some of these foreign companies are subject to international sanctions.

How did this research come about?

Western countries announced the first sanctions after Russia recognized the so-called Donetsk and Luhansk People’s Republics on February 21, 2022. Many foreign companies left Russia after this, but not all. «Chronicles.Media» studied Russian legal entities where founders from Scandinavian countries (Denmark, Norway, Finland, Sweden) were listed according to the «Kontur.Focus» contractor verification service. We collected this data as of the date of the full-scale Russian invasion of Ukraine (February 24, 2022) and looked at what happened next with these legal entities and their owners.

Research methodology

Owners of limited liability companies (LLCs) were easily verified using extracts from the Unified State Register of Legal Entities (EGRUL). However, shareholders of joint-stock companies (JSCs) are not presented in the register in an up-to-date manner. Such information can only be obtained if the company originally belonged to foreigners or if there is only one sole owner. Based on this, «Chronicles.Media» checked some of these companies not through the EGRUL but through a Russian government resource for financial reporting. On this website, JSCs are required to publish annual audit reports and explanations of financial statements (although not all of them do). These documents usually indicate the owners of the companies.

Often among the foreign owners of Russian legal entities, there are Scandinavian subsidiaries of international corporations registered in other countries. In such cases, «Chronicles.Media» considered these Russian companies to be owned by Scandinavians. For example, the Norwegian company Russian Baltic Pork Invest is owned by the large Thai holding Charoen Pokphand Foods. However, we considered Russian Baltic Pork Invest to be owned by Norwegians rather than Thais because its immediate owner is registered in Norwegian jurisdiction.

On the other hand, the Finnish state-owned company Fortum owns energy assets in Russia that are officially recorded under the Dutch subsidiaries of the company. Such legal entities were not included in our research.

«Chronicles.Media» decided to proceed in this way because otherwise, it would have been necessary to study all Russian legal entities owned by foreigners. Then, it would have been necessary to unravel the complex web of owners, often with offshore intermediaries. The editorial team considers it reasonable that the country bears responsibility for legal entities on its territory, even if they are owned by foreign corporations.

Denmark

What was there before the invasion?

At least 173 companies with Danish legal entities as founders were operating in Russia as of February 24, 2022. The revenue of these companies for the last reporting period (hereinafter referred to as 2022; if the company was liquidated after the start of the invasion — 2021) amounted to 176.5 billion rubles or 2.4 billion euros (hereinafter at the average annual exchange rate in 2022 — 72.48 rubles per euro).

Danish companies were mainly registered in Moscow (46.2%), St. Petersburg (14.5%), and the Moscow region (10.4%). But they earned the most in Moscow (45.4%), Moscow region (31.4%), and Leningrad region (8.1%).

What now?

The majority of these companies (70.5%) remained in Russia. 51 companies (17.9%) changed owners, and 20 companies (11.6%) were liquidated. The revenue of the departed companies amounted to 32.8 billion rubles or 0.5 billion euros (with the share of liquidated entities accounting for 1.8 billion rubles or 0.03 billion euros).

Remaining

Out of the 173 Danish companies studied by «Chronicles,» the majority continue to operate — 122. Their revenue amounted to 143.7 billion rubles. They primarily generate income in Moscow (43.8%), the Moscow region (35.6%), and the Leningrad region (9.8%).

The largest Danish company still operating in Russia is LLC Rockwool. It is registered in the Moscow region and belongs to the Rockwool holding. The company has explicitly stated that it continues its operations in Russia.

Rockwool produces thermal insulation materials. Its revenue for 2022 amounted to 22.6 billion rubles or 0.3 billion euros. The Danish holding also retains LLC Rockwool-Volga in Russia, while the Russian representation includes LLC Rockwool-Ural and LLC Rockwool-North. The combined revenue of these three companies for 2022 amounted to 9.7 billion rubles or 0.1 billion euros.

Second in terms of revenue is Moscow-based LLC Novo Nordisk. It belongs to one of the largest European insulin manufacturers, Novo Nordisk. In 2022, the newspaper «Kommersant» reported that the Danes might hand over their Russian business to third-party investors, but this did not happen. The company declined to comment to «Chronicles.Media.»

Novo Nordisk’s revenue for 2022 amounted to 15.4 billion rubles or 0.2 billion euros. Additionally, the Danish company has another entity in Russia — LLC Novo Nordisk Production Support. Its revenue for 2022 amounted to 1.1 billion rubles or 0.02 billion euros.

Third in terms of revenue is the Russian subsidiary of the Danish footwear manufacturer Ecco — LLC Ecco-Rus. The company did not leave the Russian market, which led to many European retailers boycotting it. Due to this, Ecco even lost its status as a supplier to the Danish royal court. Ecco-Rus’s revenue for 2021 amounted to 14.7 billion rubles or 0.2 billion euros.

And finally, LLC Pindstrup from the Pskov region, owned by the Danish group Pindstrup. This Russian entity is under sanctions from Ukraine. The company extracts peat. In the financial statements published in March 2024, the company claims that in the summer of 2022, it entered into a deal to sell its Russian asset. However, it could not complete the deal due to legal obstacles from the EU and Russia arising after the invasion of Ukraine. As a result, Pindstrup relinquished its management and financial rights to the Russian entity. The company claims to be making efforts to sell these shares.

Nevertheless, in 2022, the revenue of the Russian organization grew by a third and amounted to 1.9 billion rubles or 0.03 billion euros.

Norway

What was before the invasion?

At least 123 companies with Norwegian legal entities as founders were operating in Russia as of February 24, 2022. Their revenue for the latest reporting period amounted to 61 billion rubles or 0.8 billion euros.

Norwegians were primarily represented and generated income in the Kaliningrad region (22.1%), Yamalo-Nenets Autonomous Okrug (18.8%), and Moscow (14.9%). These companies predominantly developed computer software and were involved in the hotel business. However, they also derived revenue from oil production and pig farming.

What now?

Remaining

The majority of Norwegian companies studied by «Chronicles» continue to operate in Russia (78 out of 123). 21 enterprises were liquidated. In 24 cases, Norwegian shares were either transferred to other owners or the assets were sold entirely.

The revenue of the remaining Norwegian companies in Russia for the latest reporting period (2022, or 2021 if the enterprise was liquidated after the start of the invasion) amounted to 29.6 billion rubles or 0.4 billion euros.

Norwegian companies primarily generate income from the Kaliningrad (45.6%) and Nizhny Novgorod (21.8%) regions, as well as from Moscow (16.4%).

The largest Norwegian organization officially continuing to operate in Russia is RBPI (Russian Baltic Pork Invest). It is registered in Norway but has belonged to the Thai company Charoen Pokphand Foods for several years. Norwegian companies have a dozen subsidiaries in the Kaliningrad and Nizhny Novgorod regions. These include LLCs: «Pravdinskoye Svinnoproizvodstvo-2,» «Farm Construction,» «NNPP,» «NNPP-2,» «RBPI Partner Zapad,» «Kornevo,» «UK RBPI Group,» «RBPI Elite Seeds,» «Rechnoye,» «RBPI Partner Vostok,» «RBPI Voronezh,» and CJSC «Pravdinskoye Svinnoproizvodstvo.» The aggregate revenue of these entities, excluding their subsidiaries, for 2022 exceeded 19.2 billion rubles or 0.3 billion euros. These organizations are engaged in agriculture, primarily pig farming.

Another major Norwegian company continuing to operate in Russia is Crayon Group AS. Its field is IT. In April 2022, the organization announced that it was leaving Russia. However, Crayon Group AS still remains the majority owner of LLC Crayon in Moscow. Its revenue for 2022 amounted to nearly 1.5 billion rubles or 0.02 billion euros. The company’s public report for 2022 stated that the «situation in Ukraine is noted by the Company.»

Another Russian entity with Norwegian roots that earned revenue of over a billion rubles in 2022 is LLC GE Healthcare Pharma. It is a subsidiary of Norwegian GE Healthcare. It trades in pharmaceutical and medical products, primarily X-ray contrast agents and MRI agents. The company’s revenue for 2022 amounted to 1.9 billion rubles or 0.03 billion euros.

«GE Healthcare’s diagnostic and visualization medical products are essential for healthcare professionals and patients worldwide. We continue to supply and service the necessary medical equipment in Russia, closely collaborating with relevant authorities worldwide to ensure compliance with restrictions, as well as all laws and regulations,» GE Healthcare responded to «Chronicles’ inquiries.

Finally, another Norwegian-registered company whose Russian subsidiary earned revenue of over a billion rubles in 2022 is Gonvarri Material Handling and its Russian branch LLC Constructor Rus. The company manufactures and supplies industrial storage systems. Its revenue for 2022 amounted to 1.5 billion rubles or 0.02 billion euros.

All still cannot leave

The revenue of departed Norwegian companies (31.5 billion rubles or 0.4 billion euros) in 2022 accounted for almost half of the total (61 billion rubles or 0.8 billion euros). Completely liquidated enterprises generated revenue of 1.1 billion rubles or 0.02 billion euros. Most entities disappeared or changed owners in St. Petersburg (37.8%) and Moscow (17.8%).

However, not all entities can be said to have left completely. For example, the largest by revenue liquidated company was LLC De-Kastri Tags. It provided chartering services for maritime vessels. It was equally owned by Norwegian companies Rieber Shipping and Mco 5. LLC De-Kastri Tags’ revenue for 2022 amounted to 466.4 million rubles or 6.4 million euros.

In June 2022, Rieber Shipping announced that it was leaving the Russian market and withdrawing its vessels from the Russian Federation. However, apart from the closed De-Kastri Tags, the company is still listed as one of the co-owners of Sakhalin-based LLC Polarus, where it owns half.

In Polarus’ financial statements for 2022, it is stated that its second owner, PJSC Primorskoye Morskoye Parokhodstvo, is negotiating to buy out shares from the Norwegians. From the same report, it is evident that the foreign company provided «technical support services for vessel operation» to Polarus in 2022 and paid almost 3.5 million rubles or 0.05 million euros for it. Polarus specializes in providing chartered vessels.

Finland

What was before the invasion?

At least 483 companies with Finnish legal entities as founders were operating in Russia before the invasion of Ukraine. Their combined revenue for the latest reporting period amounted to 361.8 billion rubles or 5 billion euros.

The majority of Finnish companies were located in St. Petersburg (52.2%), Moscow (20.7%), and the Leningrad Oblast (7.2%). Most of the revenue also came from these regions.

What now?

Most Finnish companies (300) continue to operate in Russia. Only 19.6% changed ownership, and only 10.8% were liquidated. In total, 183 companies with Finnish roots stopped operating in Russia. Their total revenue amounted to 196.3 billion rubles or 2.7 billion euros, of which 18.1 billion rubles or 0.3 billion euros were attributed to the liquidated companies.

Remaining

Out of the 483 companies studied by «Chronicles,» the majority — 300 — continue to operate. Their revenue amounted to 165.5 billion rubles or 2.3 billion euros.

The top company by revenue is Moscow-based LLC Elkat. It belongs to the Finnish Prysmian Group Finland, which is part of the Italian holding company Prysmian Group. The company manufactures cables. The Finnish enterprise owns 40% of the Russian subsidiary. Neither the Finns nor the Italians have announced that they are leaving the Russian market or suspending operations there. Elkat’s revenue for 2021 amounted to 26 billion rubles or 0.4 billion euros.

The second-largest company by revenue is Makita. It belongs to the Finnish Makita, which is part of the Japanese holding company of the same name. The company manufactures and supplies power tools. Finns own only 0.2% of the Russian subsidiary’s capital, with the rest distributed among British and Japanese entities. The revenue of the Russian Makita for 2022 amounted to 18.6 billion rubles or 0.3 billion euros.

In response to «Chronicles’ inquiries, companies stated that they do not conduct any business in Russia and are not associated with the country.

Third in terms of revenue is the St. Petersburg-based paint manufacturer LLC Tikkurila. It belongs to the Finnish Tikkurila. The Finns announced their withdrawal from Russia back in 2022. However, it is now known only that the company’s Lipetsk assets have been sold. The revenue of the Russian Tikkurila for 2022 amounted to 10.9 billion rubles or 0.2 billion euros.

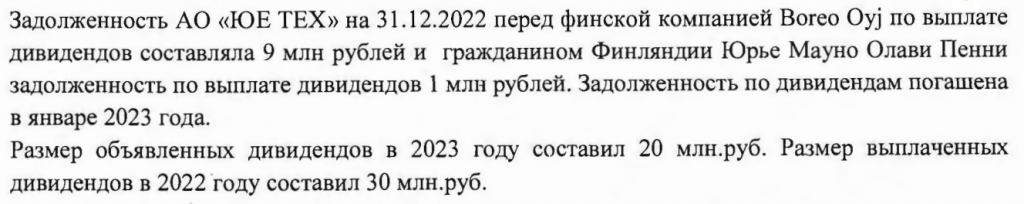

Among the companies with Finnish owners that continued operations are those subjected to sanctions by Ukraine and the United States. This includes JSC Yue Tech. Until 2022, Yue Tech belonged to the Finnish company Boreo, after which it was transferred to one of Boreo’s minority shareholders — the Finnish company Highland-Investment. It is owned by Finnish citizen Juha Mauno Olavi Penni. He is also a co-owner of the Russian company. Yue Tech supplies various electronic components. In its annual report, Yue Tech explicitly states that «this area is one of the most affected by the disruption of logistical chains,» so in 2023, they reoriented to suppliers from China and Russia. The company’s revenue for 2023 amounted to 1 billion rubles or 0.01 million euros. Moreover, Yue Tech continues to pay dividends despite the sanctions.

In 2022, it paid out 30 million rubles or 0.4 million euros, including 10 million or 0.1 million euros in January 2023. The announced dividend amount for 2023 was 20 million rubles or 0.3 million euros.

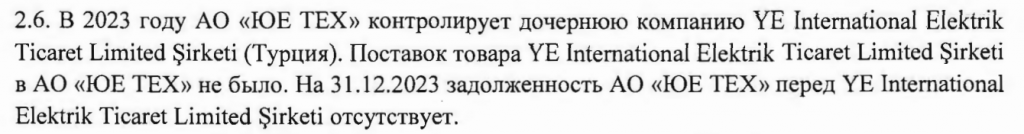

«Yue Tech» also controls the Turkish company YE International Elektrik Ticaret. Journalists have repeatedly reported that Turkish companies may be used to circumvent international sanctions against Russia.

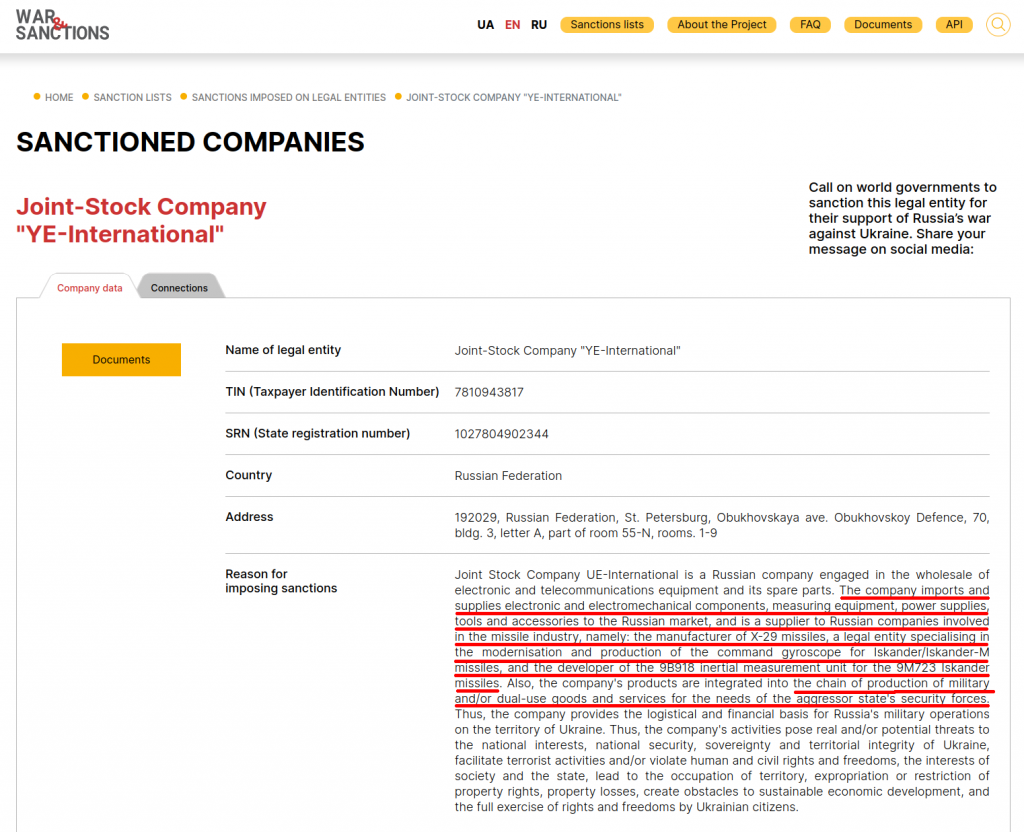

Previously, «Yue Tech» was called JSC «YE-International». It was renamed on August 7, 2023. It is known that this organization participated in the international military-technical forum «Army 2019».

Until March 22, 2024, detailed information about «YE-International» was available on the Ukrainian government’s website «International Sponsors of War» with a list of sanctioned companies. However, the Ukrainian government closed this site under pressure from diplomats of other countries. «Chronicles.Media» preserved a screenshot of this information

According to this data, «YE-International» supplied electronics to Russian enterprises involved in missile production. This includes manufacturers of X-29 missiles, which are also used to attack Ukraine. «YE-International» also assisted manufacturers of operational-tactical missile systems «Iskander» and «Iskander-M». The Ukrainian side also noted that the company’s products are integrated into the production chain of goods and services for military and/or dual-use purposes.

Finn Juha Mauno Olavi Penni is also associated with other Russian companies: «YE Complex Service Solutions» (through the Finnish companies Telercas and Ylämaa-Investment, owned by Juha Penni), «YE Photonics» (owned by Dualtek), «Innovative Solutions» (owned by Dualtek), and «YE Partners» (owned by Juha Penni). These companies also supply various electronic components.

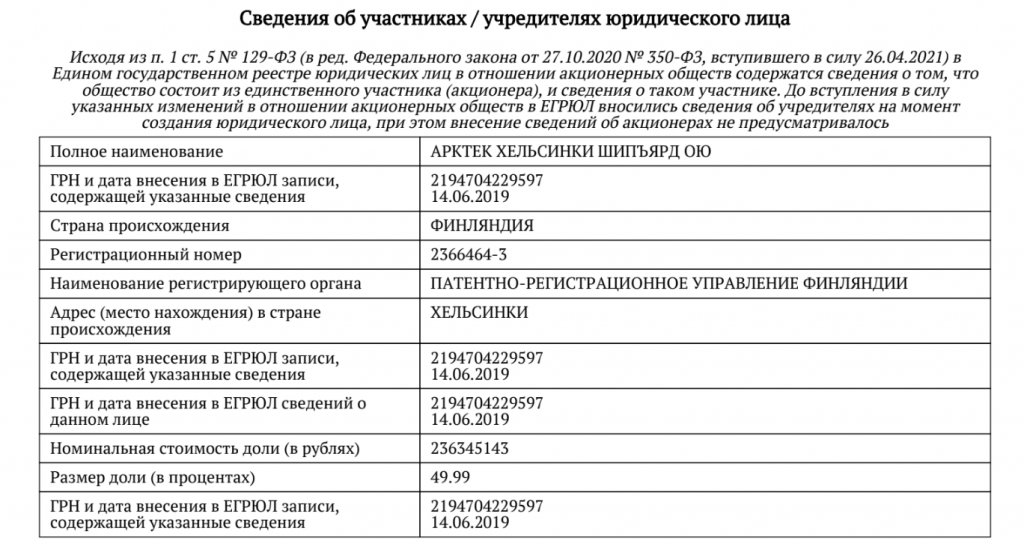

Another Finnish company operating in Russia and under Ukrainian sanctions is LLC «Nevsky Shipbuilding and Ship Repair Plant» located in the Leningrad Region. It belongs to Arctech Helsinki Shipyard. The revenue of the plant for 2020 amounted to 4.7 billion rubles — later data is not available. In March 2024, Finnish Arctech Helsinki Shipyard was liquidated, but in the Unified State Register of Legal Entities, it is still listed as the sole owner of the «Nevsky Shipbuilding and Ship Repair Plant».

Assets pledged

Several Finnish companies, in order to stay in Russia and preserve their reputation, used a simple scheme: their Russian assets remained under their own pledge.

Thus, the largest by revenue of the liquidated Russian companies owned by Finns was LLC «Stora Enso Forest West». It produced timber in Karelia. The company was a subsidiary of the Finnish Stora Enso. Before liquidating the legal entity, it was transferred to the newly created Russian company «Setnovo Group», but the assets themselves remained pledged to the Finns. The revenue of LLC «Stora Enso Forest West» for 2021 amounted to 5.3 billion rubles or 0.07 billion euros.

In the same way, two more Russian legal entities of Stora Enso were liquidated: LLC «Terminal» and JSC «Stora Enso». The revenue of these companies for 2021 amounted to 142.9 million rubles or 2 billion euros. The assets of «Stora Enso Forest West» and «Terminal» were transferred to another company, previously owned by Stora Enso — LLC «Setnovo». The latter became the property of «Setnovo Group». Its share is fully pledged to the Finns. After Stora Enso left Russia, the revenue of the continuing LLC «Setnovo» for 2022 amounted to only 1.9 billion rubles or 0.03 billion euros. The owner of it, «Setnovo Group», earned only 5.4 million rubles or 0.08 million euros.

Several more assets of Stora Enso were transferred to Russian owners. Thus, the company «Novo Packaging BB» was transferred to the ownership of LLC «Novopak», owned by the management of «Novo Packaging BB», while the share of «Novopak» remained fully pledged to the Finnish company. LLC «Setles» and «Setnovo Transport» were transferred to the aforementioned «Setnovo Group», also remaining pledged to the Finns. Finally, two joint-stock companies «Ladenco» and «Olonetsles» in August 2022 also passed into the ownership of «Setnovo Group» and related companies. The total revenue of these Russian legal entities for 2022 amounted to 12.2 billion rubles or 0.2 billion euros.

Stora Enso is not the only Finnish company that, while leaving the Russian market, sold assets for its own money. Many organizations, although owned by Russian owners, are pledged to the Finns. In addition to the aforementioned «Setnovo», foreigners thus retained control over «Lindeyli» (Lindström), «Banmark», «Sumeko», «Europress Group», and others.

Sweden

What was before the invasion?

Before the start of the invasion, at least 287 companies with Swedish legal entities among their founders were operating in Russia. Their total revenue for the last reporting period amounted to 438.2 billion rubles or 6.1 billion euros.

The majority of revenue was generated by entities registered in the Moscow region (36%), St. Petersburg (34.4%), and Moscow (22%).

What now?

As for the aftermath, out of the 287 Swedish companies examined by «Chronicles,» 87 left Russia. However, only 31 of them were liquidated. The revenue of all departing companies amounted to 293.4 billion rubles or 4.1 billion euros, of which 3.5 billion rubles or 0.05 billion euros were attributed to the liquidated entities.

Remaining

The majority (200) of Swedish companies continue to operate in Russia. Their revenue for 2022 amounted to 144.8 billion rubles or 2 billion euros.

They primarily earn in Moscow (37.4%), the Moscow region (37.4%), and St. Petersburg (15.5%).

The largest Swedish company still operating in Russia today is LLC «H&M Hennes & Mauritz,» owned by the Swedish multinational clothing retailer H&M. The company announced its departure from Russia in March 2022. However, it is still legally present in the Russian Federation. The company’s revenue for 2022 amounted to 29.3 billion rubles or 0.4 billion euros.

In response to «Chronicles,» H&M stated that they closed all Russian stores on November 30, 2022, but the company has not yet completed all necessary procedures to fully withdraw from Russia.

In second place is LLC «Hoppy Union,» owned by the Swedish company Carlsberg Sverige Aktiebolag. «Hoppy Union,» as indicated in the reports, produces and supplies malt, grain, and its processed products. Additionally, the company holds a small stake in the nationalized «Baltika Brewery Company.» The revenue of «Hoppy Union» for 2022 amounted to 10.9 billion rubles or 0.2 billion euros.

In third place is LLC «Volvo Cars,» an importer and distributor of Volvo automobiles, spare parts, accessories, and software for the onboard computers of these vehicles. The revenue of «Volvo Cars» for 2022 amounted to 8.8 billion rubles or 0.1 billion euros.

The Swedish Volvo company itself belongs to the Chinese multinational company Geely. The brand remains in Russia but does not import new automobiles; it only services those that were already in the country. In the summer of 2023, Ukraine included Geely in the list of «international war sponsors.» Sweden even considered boycotting Volvo because of this. Swedish Volvo Cars announced in 2023 that it closed its Russian division; however, as seen, this is not entirely accurate.

The Swedish Volvo Construction Equipment division, which produces construction equipment, also had other assets in Russia, including LLC «Volvo Construction Equipment East,» CJSC «Volvo East,» and others. They were sold to a Russian owner.

The next company in our ranking is LLC «Epiroc Rus,» owned by subsidiaries of the Swedish manufacturer of mining equipment Epiroc. In 2022, the company announced that it was suspending deliveries to Russia but did not leave the country. By the end of 2022, the staff of the Russian company had been reduced by almost 20%, and revenue had almost halved. However, the revenue of «Epiroc Rus» for 2022 amounted to a significant 7.8 billion rubles or 0.1 billion euros. Epiroc confirmed to «Chronicles» that they still have an active legal entity in Russia; however, the company claims that it is not engaged in any activities.

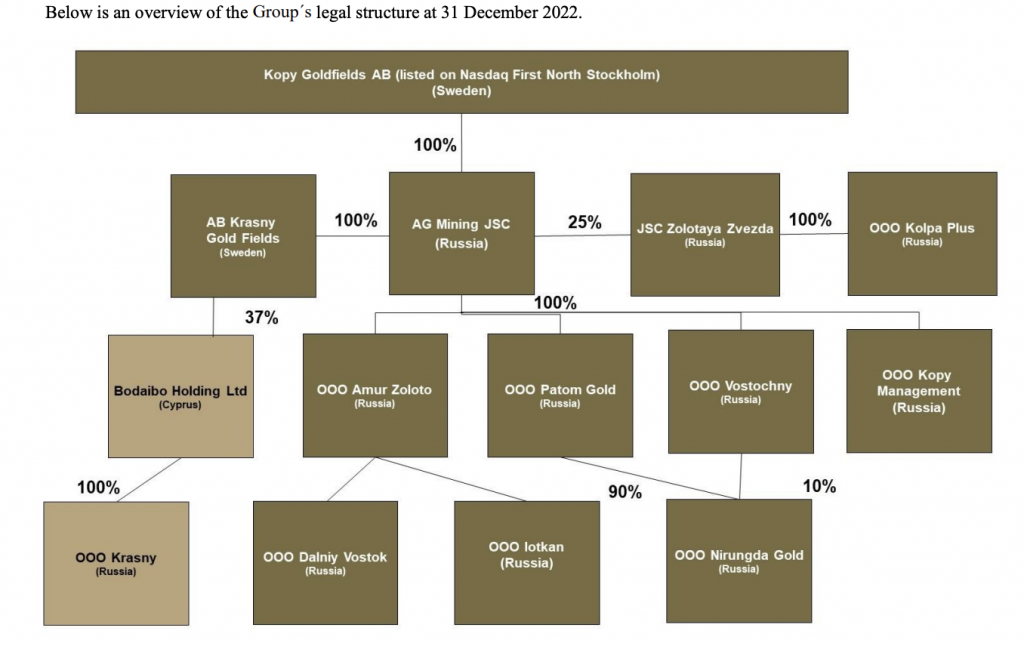

Fifth in terms of revenue is LLC «Amur Gold,» which mines this precious metal in the Khabarovsk Territory. The enterprise is owned by PJSC «AG Mining,» which, according to reports, is owned by the Swedish company Kopy Goldfields. It specializes in gold mining in Russia and controls a number of other Russian gold mining companies. In March 2022, the Swedes expressed sympathy for those «who suffered and who lost their loved ones due to the current geopolitical situation» and complained about the difficulties faced by its subsidiaries in Russia due to sanctions. And that’s it. After that, the company even expanded its presence in Russia. «Amur Gold,» however, is under sanctions from Ukraine. The company’s revenue for 2022 amounted to nearly 6 billion rubles or 0.1 billion euros.

One of the companies continuing operations in Russia is JSC «Svenska Hyuset,» owned by the Swedish government by 36%. It leases apartments and offices in St. Petersburg at 1-3 Malaya Konyushennaya Street, which is a former residential building of the local Swedish evangelical church.

The premises are leased by «Svenska Hyuset» on a long-term lease basis until 2045. The largest tenant was the Ministry of Foreign Affairs of Sweden, which housed the Swedish consulate until 2023. Besides Swedish authorities, the owners of «Svenska Hyuset» also include the Swedish company Ladoga Holding (49%), owned by a Swedish real estate management entity, CA Fastigheter. Another co-owner of «Svenska Hyuset» is the government of St. Petersburg (15%). In 2023, the authorities of St. Petersburg announced their intention to sell this stake.

Another noteworthy company is JSC «Kappa Rus» (formerly «Smurfit Kappa Rus»), specializing in cardboard packaging production. At the beginning of the Russian invasion of Ukraine, the company belonged to the Swedish division of the Irish company Smurfit Kappa Group — Smurfit Kappa Packaging Sweden Aktiebolag. In the spring of 2022, the Irish announced plans to leave the Russian market. On March 17, 2023, Smurfit Kappa Packaging Sweden Aktiebolag sold its Russian assets to another Swedish company — Sverige International Holdings. It was established in 2022 by Swedish citizens Patrik Ström, who was the general director of Russian «Smurfit Kappa Rus» at the time. Essentially, one Swedish company «sold» its Russian business to another Swedish company. The direct management of the Russian legal entity remained unchanged. The revenue of JSC «Kappa Rus» for 2022 amounted to 14 billion rubles or 0.2 billion euros.

Not Entirely Departed

The departed Swedish companies primarily earned revenue in St. Petersburg (43.7%), the Moscow region (37.1%), and Moscow (14.6%). However, not all of them managed to bid farewell to Russia.

For instance, the well-known LLC «Baltika Brewery Company» belonged to the Swedish company Carlsberg Sverige Aktiebolag. It is part of the Danish holding Carlsberg. In March 2022, they announced their departure from Russia. In June 2023, it was reported that there was a contender for the company’s Russian assets. However, in July 2023, Putin, by his decree, imposed «temporary administration» over «Baltika,» whose revenue for 2022 exceeded 100 billion rubles or 1.4 billion euros. Meanwhile, under the control of the Swedish Carlsberg Sverige Aktiebolag, LLC «Hoppy Union» remained (a co-owner of «Baltika,» but their stake ended up in «temporary administration»).

The next entity is LLC «FN Machines.» Previously, it belonged to the Swedish Ferronordic. It is a dealer of Volvo trucks and special equipment (owned by the Chinese multinational company Geely). Ferronordic also services this equipment. The revenue of the Russian legal entity for 2022 amounted to 24.4 billion rubles or 0.3 billion euros. At the end of 2022, the Swedes sold the company for 9.2 billion rubles or 0.1 billion euros. However, the former owners retained the right to buy back 75.1% of the shares at a pre-agreed price within seven years. The deal included other Russian companies of Ferronordic: «FN Service,» «FN Trading Company,» «FN Real Estate.» Their revenue for 2022 amounted to 11.3 billion rubles or 0.2 billion euros.

***

More than 1,500 foreign companies were operating in Russia at the beginning of the invasion of Ukraine, according to researchers from the Yale School of Management. By spring 2024, over a thousand organizations announced that they were ceasing business in Russia, but hundreds of enterprises still remain in the country. It turns out that the majority of them are from Scandinavia.